Requested guidance would ensure rural communities, states have funding and flexibility

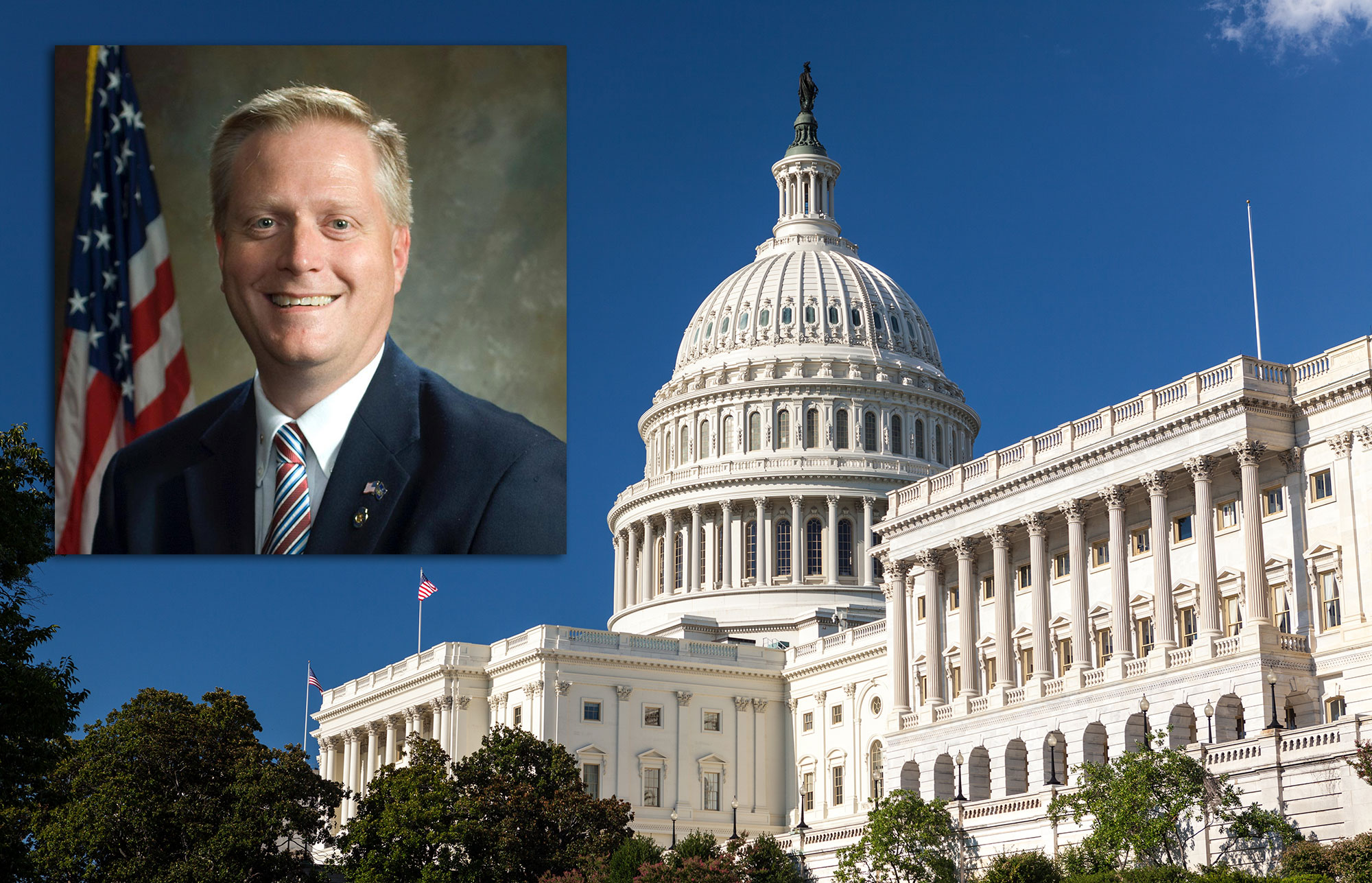

Washington, D.C. – Congressman Fred Keller (R-PA) led a Pennsylvania Republican Congressional

Delegation letter to Treasury Department Secretary Steven Mnuchin Wednesday asking the Treasury

Department to ensure equitable disbursement of federal funds across local governments while granting

states the flexibility they need to provide critical services.

Specifically, the letter urges the Administration to issue additional guidance on the Coronavirus Relief

Fund created by Congress to allow states and local governments flexibility to offset lost revenue at the

state and local level by applying for a waiver to the Treasury Department that could be granted if states

first develop and execute an approved distribution formula providing an equitable share of their

Coronavirus Relief Fund money to counties and municipalities with fewer than 500,000 residents.

“Under this proposal, states would first have to present to the Treasury Department plans to equitably

disburse funds to localities,” the letter states. “Once the Treasury Department approves the plans and

states disburse the funds to localities, Treasury could then work with states to loosen restrictions on

acceptable expenses for states’ share of remaining Coronavirus Relief Fund dollars, while subjecting

those expenses to states’ normal appropriations processes.”

The letter was co-signed by seven other members of Pennsylvania’s Republican Congressional

Delegation, including Congressman Glenn “GT” Thompson, Congressman Mike Kelly, Congressman Scott Perry, Congressman Lloyd Smucker, Congressman John Joyce, Congressman Dan Meuser, and

Congressman Guy Reschenthaler.

The $150 billion Coronavirus Relief Fund was created under the CARES Act to give relief to states and

local governments for unexpected expenditures incurred directly as a result of COVID-19. Of the fund’s

$150 billion, Pennsylvania received just under $5 billion. According to the fund’s requirements,

Pennsylvania’s seven most populous counties were able to apply directly to the U.S. Treasury for just

over $1 billion of Pennsylvania’s share. The remaining funds, totaling close to $3.9 billion, are left to the

Commonwealth to be used for unexpected expenses incurred directly as a result of COVID-19.

Current guidance from the Treasury Department states that Coronavirus Relief Fund dollars may only be used for certain COVID-19-related expenses and specifically prohibits the use of these funds to offset

lost revenue as a result of COVID-19.

“This proposal would serve the dual purpose of ensuring no county or municipality is left out of federal

COVID-19 relief funding and provide the flexibility state governments need to respond to the pandemic,

serve the public and balance their budgets,” the letter states. “This would also reduce the burden on

state and local budgets as a result of lost revenue and mitigate the need for additional state and local

funding currently being discussed as part of any potential future federal legislation.”

You can read the letter in full HERE.

04.29.20 Letter to Treasury re Local Funding Guidance

On the letter and potential additional relief for state and local governments, Congressman Fred Keller

(R-PA) made the following statement:

“The federal government has appropriated $3 trillion of taxpayer money to provide relief during the

COVID-19 pandemic, including $150 billion to states and local governments in the Coronavirus Relief

Fund. While necessary, this funding has already increased our deficit and burdened future generations

with paying off our growing federal debt.

“As Congress considers additional legislation to combat COVID-19, we should not be sending

unrestricted cash payments to states to bail out their long-standing debt. Prior to COVID-19, and despite

the strongest economy the world has ever seen, the Pennsylvania Independent Fiscal Office’s November

2019 report found that Pennsylvania was already running a half-billion dollar deficit at the end of 2019

and that the Commonwealth would need almost $1 billion to balance its budget for the upcoming fiscal

year.

“The guidance we are requesting from Treasury will ensure local governments get the funding they need

and the state and local governments have the flexibility to use already appropriated federal money to

help mitigate the revenue impacts brought about by COVID-19. It will also ensure the Trump

administration and state legislatures can play a critical oversight role in the effective and appropriate

distribution of these dollars.”